If you read our previous article we wrote about average salary in India and how it compares around the world.

However before you know about average salary you need to how a salary is calculated.

In this article we will talk about how to calculate gross salary and how it is different than net salary.

Before I tell you how to calculate gross salary you need to know different types of salary.

There are two kinds of salary or three maybe.

1. Gross Salary

Gross Salary is the whole amount calculated after adding all the benefits and allowances without deducting any tax.

So you calculated everything in lump sum then it is called as Gross Salary, it is aggregation of everything.

2. Net Salary

Net salary is what is left after reduction or deducting many things that includes taxes. There are other things to deduct that will talk in coming paragraph.

3. Take Home Salary

Finally you have Take Home salary that you take home. It is the real money that is in your hand. Amount that is deducted here is your loan or bond re payments. I mean to say anything other than taxes.

So these were three kinds of salaries that you got to know.

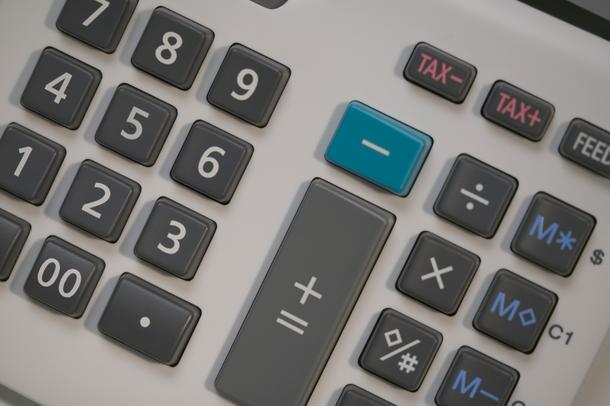

Let us see how gross salary is calculated.

We are taking an example where we give you various variables that go into calculating gross salary of an employee in working for a firm.

Various Components Amount

Basic Salary 500,000

Dearness Allowance 50,000

House Rent Allowance 100,000

Conveyance Allowance 12,000

Entertainment Allowance 12,000

Overtime Allowance 12,000

Medical Reimbursements 16,000

Gross Salary 7,00,200

Benefits Depending upon the company you work for

We have not calculated benefits because benefits depend upon the organization you work with.

Now we shall discuss different variables involved one by one.

Basic Salary: It is the basic salary or stipend that has been promised to you.

Dearness Allowance: Dearness allowance depends upon the city you live in. It may go up depending upon the cost of living in your city.

House Rent Allowance: It is given for accommodation purposes so that you can accommodate your family in a house.

Conveyance Allowance: Here allowance is given for your transportation needs. It takes care for all your travelling allowances.

Overtime Allowance: You could call this as bonus that you get for every hour you work extra.

Medical Reimbursements: If you ever fall sick and spend money from your pocket that it is reimbursed.

Benefits: As I said earlier benefits includes many things depending upon the company your work with.

Difference between Gross Salary and Net Salary

We need to discuss how we distinguish between these two.

As you saw from the table that Gross Salary include

Basic Salary + All the Allowances = Gross Salary.

However after tax deductions from Gross Salary you are left with Net Salary.

Gross Salary – Taxes = Net Salary.

Taxes would depend upon the tax slab you fall in. If you fall in 10% or 20% or 30% tax bracket then that much amount is deducted from your Gross Salary.

Hence you are left with Net Salary.