Every organization gives a salary slip, also known as a pay slip, to their employees. Some employers issue the physical payslip on paper, while others email it to their staff.

A salary slip carries essential details about your earnings for a particular period. Most employees get a salary slip every month, some every fortnight, and some, every week.

However, most of us dispose of a salary slip without giving it importance. A salary slip can tell you about your total earnings and the deductions.

What is Salary Slip / Pay Slip?

A salary slip (also known as pay slip in some countries) is given to employees. Understandably, a salary slip is given to employees whose monthly income and allowances are known.

Payslip salary, in comparison, is given to workers whose income and allowances can vary according to several hours or days they work. Regardless, they both indicate your earnings.

Notably, a salary slip is a vital legal document too. Moreover, it is legally binding upon your employer to issue you a salary slip as proof and a statement of your earnings and deductions, if any.

It would be best to endorse the salary slip to acknowledge you have got the money it mentions.

Getting a salary slip or pay slip

It is your legal right to ask and get an original salary slip or payslip. Of course, you may be working for a tiny firm or private employer. However, you can always request your employer for some form of a salary slip.

The employer may hand you a simple paper indicating your salaries or wages, days worked, and deductions, if any. However, this is more than sufficient, as long as your employer signs and stamps.

Alternatively, you can get your simple salary slip from these sources:

- Human Resources/ Finance/ Administration department of your employer.

- Payroll service provider who manages salaries and wages for your employer on outsourcing basis.

- Your bank can also give your pay slip if your earnings go directly into your bank account. However, it will only indicate a salary transfer without much detail.

Importance of a salary slip

Your salary slip is essential for many reasons. Therefore, it is necessary to obtain one every month. Further, you also need to file your pay slips carefully for future reference.

1. It will decide whether or not you will pay income and other taxes. Your salary slip will also help fix how much money you will pay as taxes every year. In addition, you will know how much income tax returns you can claim from the government.

2. The salary slip also ensures access to certain government services that are given free or with heavy subsidies. It will include state-run medical care and cheaper food grains from the public distribution system.

3. Further, bank credit, loans, housing mortgage, and other borrowings you can avail is decided by the salary slip. Banks and lending institutions will ask for copies of salary slips while applying for credit or loans. Payslips help banks assess your creditworthiness and repayment capability.

4. A pay slip plays the role of a bargaining chip when negotiating salary with a new employer. Large companies ask for copies of the last salary slip to prove your earnings. It helps them decide how much to pay you.

5. Unfortunately, salary slips sometimes work against income earners facing divorce proceedings. For males, it can decide how much alimony to pay. In the case of women, the maintenance and compensation they get will be based on the husband’s salary slips.

6. In Some Arabian Gulf countries, a salary slip decides whether or not you should get a liquor permit. It is illegal to buy alcohol without a liquor permit in these countries. Unless you earn a specific amount or more, you will not get a liquor permit.

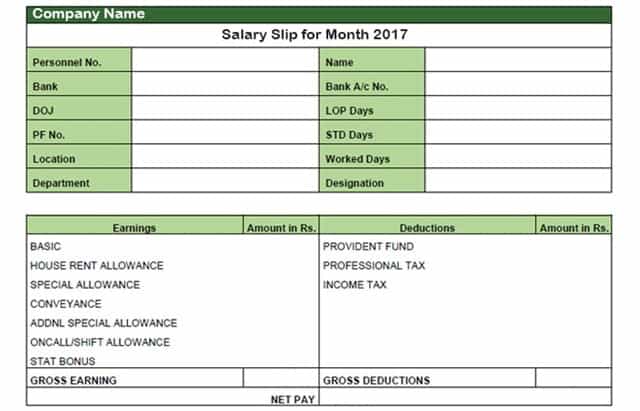

Salary slip format and info

For newcomers, reading a salary slip can be daunting. It can be equal to deciphering hieroglyphics. Yet, here are some fundamental indicators about some of the information your salary slip will contain. The data will vary by employer and country.

- Number of days/ hours of your work

- Number of days you did not work

- Official holidays ( Festivals, national days and weekends)

- Basic Salary

- Housing and Residence Allowance

- Transport/ Commute Allowance

- Medical Allowance

- Outstation Allowance

- Payment for overtime work

- Extra pay for any reason

- Dearness allowance

- Tax deductions

- Social Security/ Provident Fund deductions

- Workplace/ group accident cover deductions

- Medical and healthcare insurance deductions

- Advance payment/ adjustments on loans

Salary Slip Format

More info on your salary slip

The salary slip in India gains more significance because of many reasons:

- It bears your full name, or your legal identity

- In most cases, your full residential address will appear on salary slip

- Your designation with the particular employer

- Employee number in the company

- Grade and ‘rank’ if any. The ‘Grade’ and ‘Rank’ system is to indicate seniority and pay scale. Often, government offices and departments, armed forces will use this system.

- Details about payment. This means the total amount paid. Further, it will indicate mode of payment- cash, cheque, bank transfer.

Computerized and manual salary slips

Manually issued salary slips are past things, as one will believe. Yet, some employers do give them. They serve two purposes- as original salary slip and receipt of payment.

In some countries, one must affix a government revenue stamp to a salary slip. Further, they bear the company’s official seal and signature of the issuing officer.

However, most companies issue digital salary slips called e salary slips. You can have them printed or stored for your future reference. Further, if you require, you can get an endorsement from the employer.

Legal validity of manual, digital pay slips

Luckily, both have the same legal status. Remember, you cannot tamper with your salary slip. It can become a criminal offense to alter or doctor a pay slip.

It can happen if you approach a labor court to resolve a salary or wage dispute. Incidentally, such cases are few because of computerization and bank transfer of wages.

Foreign salary slips

Regardless of whichever country your salary slip comes from, it has the same legal status. Salary slips from foreign countries can help you open an offshore banking account.

It can also give you the ‘Non-Resident’ status in your native country. Especially, a ‘Non-Resident’ status is helpful to save taxes.