What is the right age to invest? Should you invest as a child or during your 20s, 30s, 40s or when in life?

My answer to your question is simple. Any age is the right age to invest, and every age is an early age to invest. My response might sound a bit confusing to everyone. So, I will explain a bit more.

Some Examples of Early and Late Investors

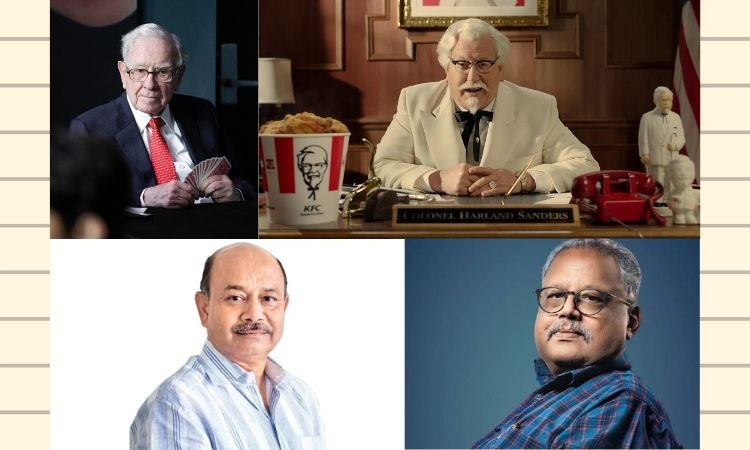

American billionaire, Warren Buffett, said to be the fifth richest man in the world, made his first investment at the age of 11 years.

He bought six shares of Cities Service, three for himself and three for his sister when he was just 11 years old, for a price of US$38 per share in 1941.

The prices of these shares went down to US$36 but soon rose to US$40 and later began increasing even more. Today, Warren Buffett has a net worth of $117.7 billion.

Colonel Harland David Sanders began investing in his fried chicken business using the US$105 he was getting as a social security check when he was 65 years old.

With this small amount of money, he founded the world-famous fast-food chain Kentucky Fried Chicken or what we know as KFC.

It was only at the age of 72 that he became rich when he sold the company to two American investors, John Y. Brown Jr and Jack C. Massey, for US$2 million in 1964. Today, Forbes puts the value of the KFC brand at US$8.4 billion.

Back home in India, billionaire stockbroker Rakesh Jhunjhunwala made his first investment on shares at the age of 25, with just Rs.5,000.

Today, Forbes estimates his net worth to be around US$8.8 billion, making him one of the richest persons in India.

But Radhakrishna Damani, owner of Dmart Group, met his success only at the age of around 42 years. He had struggled over the years to make his chain of supermarkets in India successful.

Today, at the age of 67 years, RK Damani is worth US$16.1 billion and is also one of the richest persons in India.

These four examples are clear proof that people anywhere in the world can invest at any point of their life and become successful and rich.

Therefore, it would be wrong for me to say which is the right age to invest. As a matter of fact, you can invest at any age and be rich and successful.

Therefore, in this article, I will teach you about what age you should start investing and why.

Savings v/s Investments

Before I talk about the right age to start investing, I will bust one of the oldest myths in India. Sadly, in India, most people, especially from what we call the middle-income group and the low-income group, don’t really invest. Instead, what they do is save.

Keeping aside some money on a fixed deposit, recurring deposit or Public Provident Fund or National Savings Certificate or Kisan Vikas Patra is all fine.

It will give you an interest of anything between five per cent per annum to eight or even 12 per cent per annum, depending on the type of plan.

In such cases, the only benefit you get is the interest. Therefore, these aren’t really investments. These are savings. These savings don’t provide you with any protection against what is commonly known as the Time Value of Money.

Investments v/s Life Insurance

Another common problem in India: many people wrongly believe that a life insurance policy is an investment. Life insurance is never an investment; I can assure you of that, nor is it a good option to save money. In fact, life insurance by itself is risky.

Firstly, if you consider the amount of money you’re paying as a premium to maintain a life insurance policy and the amount of money that your relatives or beneficiary will get after your death, you will be shocked to learn that you’re actually losing money.

Secondly, a life insurance policy comes with a lot of fine print. The insurance company might not cover you for death due to various causes, as was seen during the Covid-19 pandemic recently.

It might not cover you for most types of death, including terrorist acts, crimes or even accidents. Therefore, there’re no guarantees that your beneficiary will get the money.

And in any case, the money from life insurance goes while you’re living. This means the money that a policy will pay, will come only after your death and will hence, be useless for you.

Of course, there’re certain life insurance policies that allow you to choose when and how to get the money. But overall, you lose.

Savings & Life Insurance v/s Investments

Now, let’s put savings schemes and life insurance policies on one side and compare them with investments. Here’re some of the greatest advantages of investments.

Fixed Returns and Variable Returns

Life Insurance and Savings Schemes benefits are decided by the insurers, banks and cooperative credit societies. You can’t get more money than what they offer.

With investments in shares, mutual funds, exchange-traded funds and currencies, there’re no fixed returns. But in most cases, you will get much higher returns.

Variety of Choices

Only six different types of life insurance policies are available in India, regardless of which insurer you approach. All these policies offer the same benefits only, with slight variations.

The six types of policies can actually be seen as a marketing ploy only since they are made to attract a person to buy.

Banks and India Post also have a limited offering of savings plans. These include regular savings accounts, fixed deposits, recurring deposits, time or term deposits, senior citizen schemes, plans for women, plans for kids and so on.

However, for investments, there’re about 1,600 different kinds of stocks or shares listed on the stock market from different companies operating in various sectors of the industry.

There are more than 2,500 mutual funds listed in India from 44 different asset management companies.

Regulatory Authorities

Banks in India operate according to interest rates and other terms and conditions fixed by the apex Reserve Bank of India. All insurance companies in India can offer only those benefits that are approved by the IRDAI.

This simply means that insurance and bank savings schemes operate under a specific authority, and no bank or insurer can overstep the limits set by RBI or IRDAI.

Stock exchanges in India and Mutual Funds in India operate under the broad umbrella of the Securities and Exchanges Board of India or SEBI.

However, SEBI doesn’t regulate the prices or benefits that you can get from investments in stocks and mutual funds.

Instead, the prices of stocks and mutual funds swing upwards or spiral downwards depending on the market supply and demand. This means you have better chances to make more money by investing in stocks and mutual funds.

Risk Levels

If you thought that savings at banks and cooperative credit societies or paying insurance premiums is safe enough and doesn’t involve risks, think again.

Several cooperative credit societies have been dissolved, and persons saving with them have lost their lifetime money in just a day.

The most famous and recent case of a bank going bust is the Punjab- Maharashtra Cooperative Bank which closed down due to crises causing losses to persons who had invested in its schemes.

At best, you can get Rs.1 lakh only from the bank if it goes down. That, too, takes a long time. If you have deposited Rs.1 lakh or more and something happens to the bank, the maximum you get is Rs.1 lakh only.

Similarly, an insurance company has the right to deny paying the claim for any reason. There’re absolutely no guarantees that an insurer will pay your beneficiaries after your death.

There could be any reason for an insurer to refuse to pay your beneficiary. It could claim that your life insurance policy didn’t cover that specific kind of death.

However, an investment is relatively safe. There’re no such strings attached. If you invest in the stocks of a good company, there’re fewer chances of losing money.

The same is true with Mutual Funds. Generally, all Mutual Funds come with a ‘riskometer’, which shows the amount of risk you have to take with your money. Then, there’re Exchange Traded Funds too, which are relatively safe.

Also Read: Things To Consider Before Investing In Life Insurance Plan

Withdrawals and Minimum Amounts

You can’t abruptly cancel a life insurance policy and hope to get back all the money you’ve paid as a premium. Nor is it possible to stop paying premiums and get the full benefits of insurance coverage.

Similarly, you can lose some money for premature withdrawals of your fixed deposit, recurring deposit or other such schemes of a bank or cooperative credit society.

Also, you need a specific amount of money to buy life insurance or to keep a fixed deposit.

However, with investments, you can begin with as less as Rs.10 if you wish. There’re certain stocks available for Rs.10 or even lower.

In fact, you can buy a good share for less than Rs.100 only. Similarly, minimum investments in Mutual Funds start at Rs.100 only.

You can sell your stocks or Mutual Funds at any time and get cash within two to three days only.

What Does This mean?

In simple terms, these examples and comparisons clearly indicate a simple fact. That you can make more money by investments instead of savings and insurance, and you could start investing with smaller amounts of money.

A savings scheme could be safer but doesn’t pay enough interest to meet rising inflation. And a life insurance policy doesn’t really pay what you expect, though it can serve only as a temporary financial relief to your relatives in the event of your death.

These facts further point out that the earlier in age you start investing, the greater profits you can expect. So, here’re the benefits of investing at a younger age.

Benefits of Investing Early

Before I start telling you about the benefits of investing young, I will once again emphasise that any age is good to start your journey in the stocks and mutual funds market. However, the sooner in life you start, the better.

Here’re some benefits of investing at an early age.

1. More Investments

The younger you start, the more years you have to invest. And as your salary or income grows over the years, you can also step up your investments.

This means you can have more and more money as you near the typical retirement age of 60 years.

By the time you’re 60, you can have a superb portfolio of stocks, debentures, bonds, Exchange Traded Funds and Mutual Funds built over 20 or 30 or even 40 years.

This directly means that regardless of your income, you have some more sources of income. In fact, Warren Buffett says that every person should have at least seven sources of income. You can have several such sources by investing in younger.

2. More Flexibility

Investing at an early age also gives you a lot of flexibility in choosing investment options according to their risk profiles and returns.

Generally, younger people are more open to investing in stocks and mutual funds by taking a greater risk to earn more returns. In stark contrast, a person looks for secured investments when they’re older.

This doesn’t imply that younger people are careless with their investments. It only means that they’re willing to have a wider portfolio of investments with mixed risk profiles.

Persons older in age, however, have limited portfolio options since their emphasis is on smaller returns but greater security.

For example, a younger investor will put their money on stocks of emerging companies and Initial Public Offerings and high-risk or moderate-risk Mutual funds. In comparison, an older person will invest in time-tested and proven stocks that would give limited returns since these companies are stable.

The difference is that when you invest at an early age, you can get better and higher returns compared to investing later in your age on secure investment options and savings.

3. Better Use of Time Value of Money

A person who invests at an early age is better able to overcome the negative impact of the time value of money or TVM. Under the international laws of TVM, the value of money drops by about five per cent every year due to inflation and other costs.

That means, Rs.100 today will be worth only Rs.95 after a year. Or, what you can buy today for Rs.100 will cost you Rs.105 after a year.

So, if you invest Rs.100 today on stocks and get a return of Rs.106, or you invest on Mutual Funds and get returns of Rs.106, you have actually gained a rupee extra.

Though the Time Value of Money caused the buying power of your Rs.100 to go down after a year, the returns on investments covered it up for you and actually gave you a Re.1 profit too.

4. Early Retirement

If you’re fed up with your job or business and would like to retire before the retirement age of 60 years, investing at an early age can help a lot.

That’s simply due to the fact that you’ll have a good portfolio that pays you dividends and other returns regularly. You could use this money for your living expenses or reinvest them again to earn more returns.

A lot of people nowadays choose to retire early and benefit from the longer lifespan that people in India enjoy nowadays.

This helps them to plan their retirement well in advance. A good portfolio is superb financial security for the future too.

5. Life Without Debts

It is seen that persons that start investing at an early age are also debt free. Since they have enough money in the form of investments, they don’t feel the need to take a loan from a bank or other financial institutions to meet their needs.

In fact, lots of people are also able to buy bigger assets such as a house or expensive gold as their assets.

It's worth remembering that debt can actually set back your life by several years. As money goes towards the repayment of loans and credit cards, you have to postpone some of the major decisions in life.

However, investments mean you’re actually putting away your money and making it grow. This in itself is a superb way to prevent loans since you can depend on your own money.

Conclusion

Before ending my video, I will once again repeat that every age is a good age to start investing. Every age is an early age to invest. Therefore, if you truly wish to invest, the time is right now. You can start by opening a Demat and Trading account and start buying shares right now, during trading hours of the stock exchanges or buy a few units of mutual funds from your comfort zone using a mobile and good app.