Do you think income tax slabs are too difficult to understand? Well, it's natural. There are so many exemptions, notes, and pointers to remember within a few minutes.

The moment our finance minister starts the taxation part of her budget, we get all ears. But, no matter how attentive we are, it's likely that we'll miss out on certain pointers.

So get your notebook, sit back on your sofa, and patiently stay with me till the end of this article. I have sorted out and arranged taxation policy in a manner that’s easy to understand. As you read, you’ll come across the tax slabs for the year, conditions that come along with it, and the surcharge.

You should note that these are the slabs announced by the government for AY 2022-23, and the income tax slab 2021-22 is also valid. You can choose between them and opt for the method that best suits your financial situation.

Income Tax Slabs For FY 2022-23

Income tax in India is levied on individuals, Hindu undivided families (HUF), LLPs, and corporates on a slab basis. It means that the rate of tax varies according to the income.

These slabs enable fair tax management in the country and its progress. The government has given two options in income tax slabs, the old tax regime and the new one.

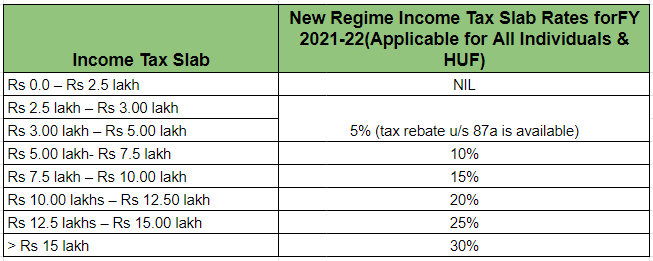

This article is to describe the new tax regime for the financial year 2022-23. Below are the tax slabs announced by the government in the union budget of February 2022.

Read also: A Guide for Tax Planning & Saving for Salaried Employee

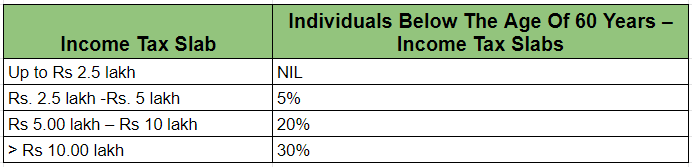

Tax slab for individuals and HUFs

Under section 115BAC of the income tax act, individuals and HUFs are allowed to opt between the old and the new income tax regime.

Exemptions and deductions (like 80C, 80D,80TTB, and HRA) will not be allowed to the taxpayer, if opted for the new income tax regime, as it readily provides concessional tax rates.

Income tax slab 2021-22 – Applicable for New Tax regime

Note:

- In the old tax regime, there were slabs for individuals, senior citizens, super senior citizens, and female taxpayers differently. Whereas in the new tax regime, all the categories are combined under a single slab.

- Senior and super senior citizens will not be able to avail increased basic exemption limit in the new income tax regime.

- An assessee can only avail of a lower tax rate if computed with total income under a particular slab without claiming any exemptions or deductions.

- The basic exemption limit for NRIs is Rs 2.5 Lakh, irrespective of age.

- 4 percent Additional Health and Education cess will be added to the income tax liability in all cases. (increased from 3 percent since FY 18-19)

Conditions for opting New Tax regime

The government of India puts forward several conditions in order for the taxpayer to opt for the new concessional tax regime. The taxpayer will have to give up on certain exemptions and deductions. In all, there are 70 deductions & exemptions that are not allowed. Listed below are a few that are most commonly used by taxpayers.

Deductions and Exemptions not eligible under the new regime

- Leave Travel Allowance (LTA)

- House Rent Allowance (HRA)

- Conveyance allowance

- Daily expenses in the course of employment

- Children education allowance

- Other special allowances [Section 10(14)]

- Standard deduction on salary

- Professional tax

- Interest on housing loan (Section 24)

- Deduction under Chapter VI-A deduction (80C,80D, 80, etc.) (Except Section 80CCD(2))

What can be claimed?

- Transport allowance for specially-abled people

- Conveyance allowance for expenditure incurred for travelling to work

- Investment in Notified Pension Scheme under section 80CCD(2)

- Deduction for employment of new employees under section 80JJAA

- Depreciation u/s 32 of the Income-tax act except for additional depreciation.

- Any allowance for travelling for employment or on transfer

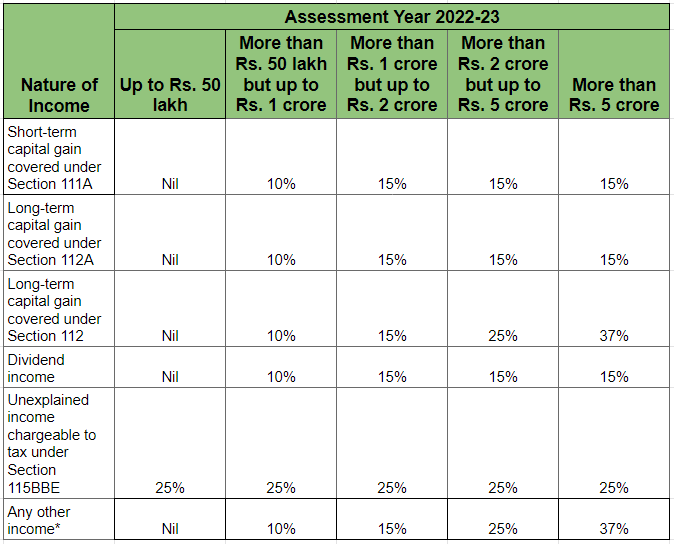

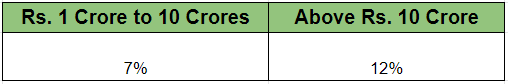

Surcharge

A surcharge, in simple words, is a tax on tax. Unlike the income tax, the surcharge is levied on the tax payable and not the income generated. It varies across different categories and income slabs like the income tax. The table below represents the categories across which the surcharge rates are divided.

Note:

- Surcharge on income u/s. 112 on the transfer of any capital asset shall be a maximum of 15 percent (applicable w.e.f AY 2023-24).

- As the case may be, the enhanced surcharge of 25 percent & 37 percent is not levied from income chargeable to tax under sections 115AD(1)(b), 111A, 112A, and Dividend Income. Therefore, the maximum rate of surcharge on tax payable on such incomes shall be 15 percent, except when the income is taxable under sections 115A, 115AB, 115AC, 115ACA, and 115E.

Income tax slab rate for the Old Tax regime

Both the tax regimes might have pros and cons depending on a person's income. For example, we get the benefit of exemptions and deductions in the old regime, whereas the new regime is at a pre-concessional rate. Below are the tax slabs based on the old tax regime.

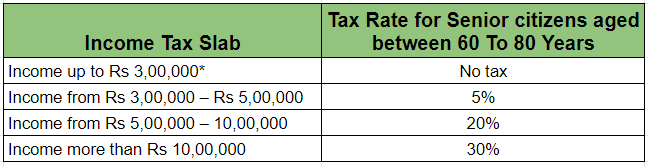

Tax Slab for Senior citizens aged between 60 To 80 Years

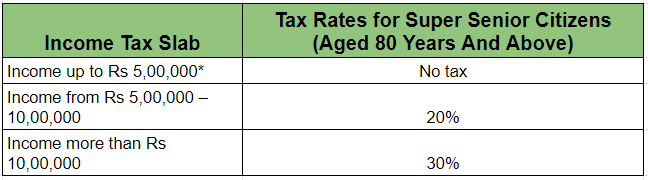

Tax Rates for Super Senior Citizens

Note :

- 4 percent Additional Health and Education cess will be added to the income tax liability in all cases.

- Surcharge: The surcharge rates for the old regime remain the same as the rates for the new income tax regime.

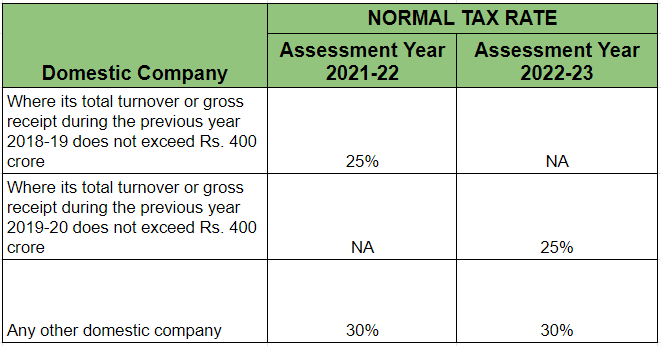

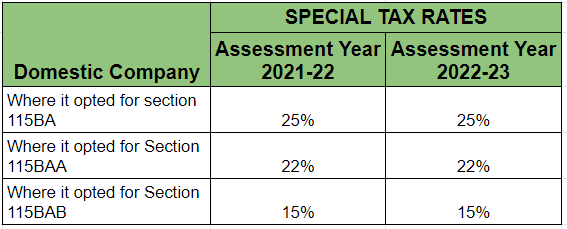

Income tax slab for domestic companies

When we talk about the companies, the scenario changes as the income amount dealt here is much higher than individuals. even the companies are given two options to opt for taxation. The slabs are as below.

Also, the Government introduced special tax rates for domestic companies under various sections. These can be summarized as:

Surcharge

Note:

- 4 percent Additional Health and Education cess will be added to the income tax liability in all cases.

- MAT Provisions as per section 115JB would also be applicable while calculating tax payable.

Conclusion

The data has been derived from a government website and is therefore legitimate. So, these are the income tax slabs announced by the government for the financial year 2022-23 (AY- 2023-24). I hope this saves you the trouble of going through difficult data and research on tons of buffering sites.