Who doesn't want to rely on the option of saving money in these modern times when money is so crucial for leading a happy and healthy lifestyle?

Investing your hard-earned money can provide you with a second stream of income.

Mutual funds are one of the most effective ways to invest your money. Although mutual funds come with their own set of hazards to consider before investing, they are also one of the best investment options if chosen wisely by analyzing the benefits.

Investing in mutual funds is also simple because you may do it through a SEBI-registered mutual fund app, a trustworthy and reliable investment platform.

10 Best App For Mutual Funds in India

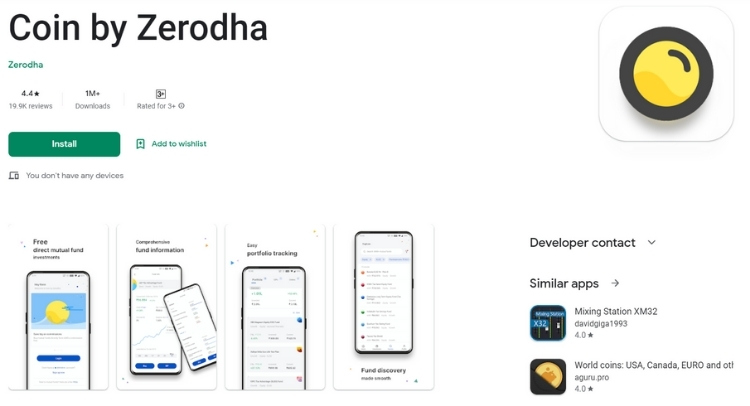

1. Coin App from Zerodha

The Coin App from Zerodha is the best mutual fund app for most investors in India. It is the first and primary choice for anyone wishing to invest in mutual funds because of its high level of convenience and functionality.

You may be sure of a high degree of devotion and user-centricity because it is backed by Zerodha, one of India's leading stockbrokers. If you already have a Zerodha account, using the Coin app to invest directly in mutual funds would be easier.

The Coin by Zerodha app allows investors to invest in roughly 40 fund houses' mutual fund schemes without commissions.

Zerodha, the top mutual fund app in India, has a significant client base, which explains why it is regarded as one of India's finest mutual fund apps. All you need is a Zerodha account, and you can immediately start investing in mutual funds via SIP.

Top Features of Zerodha's Coin Mutual Funds App:

- The portfolio management interface is simple.

- This mutual fund app in India might help you save 10 to 1.5 percent on direct SIPs.

- The app supports both iOS and Android mobile devices.

- Directly invest in mutual funds from your Zerodha account.

- SIP handling that isn't a pain

- A pricey selection of mutual funds to pick from

- UPI-based purchasing option with the opportunity to invest in ELSS funds for tax savings

| Google Rating | 4.3 |

| Total Number of App Downloads | 1M+ |

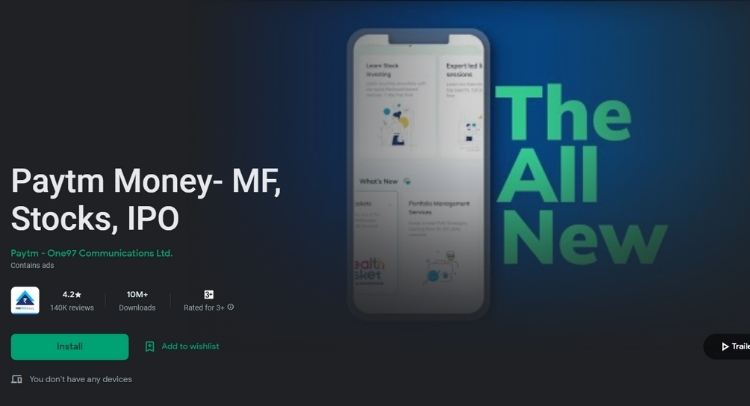

2. Paytm Money Mutual Funds app

The Paytm Money Mutual Funds app is India's most popular & best app for mutual funds. Investing in direct mutual funds allows users to obtain 1% better returns. Furthermore, the app does not charge fees for purchasing and selling mutual funds.

Therefore investing in mutual funds is completely free. A wide range of investment options makes investing in mutual funds much easier and more seamless for investors.

The app is powered by a completely paperless KYC verification process that speeds up and simplifies the account opening process.

The software makes it simple to keep track of your mutual fund holdings. Investors can also use the app to invest in various mutual funds, including liquid funds, ELSS funds, and equity funds.

Paytm Money Mutual Funds App's Key Features:

- There are no commissions on direct mutual funds.

- Account opening is 100% paperless with no AMC.

- Account statements are available for free.

- Suggestions and insights based on your portfolio

| Google Rating | 4.2 |

| Total Number of App Downloads | 10M+ |

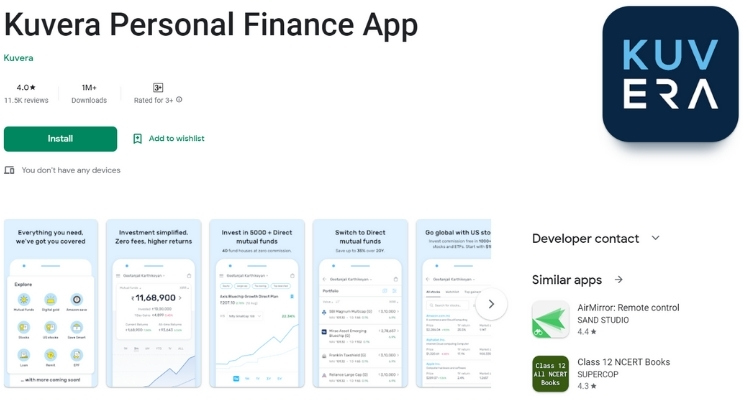

3. Kuvera

You can also utilize Kuvera, a fantastic mutual fund investment app. Kuvera features a one-of-a-kind and easy-to-use user interface, and you can establish an account in just a few minutes. You may manage joint family accounts, show financial portfolios, and keep track of your investments.

In addition, the app offers a basic yet informative dashboard where you can view all policies, financial schemes, and SIP information. It also allows you to set life objectives and measure your progress. It also suggests trending mutual funds that can help you achieve your goal.

Kuvera's top mutual fund app has the following features:

- The process of opening an account is entirely digital.

- Features for managing joint accounts in a family account

- There are no hidden fees or commissions.

- Options for tax-avoidance funds

- Investing language based on objectives

| Google Rating | 4.5 |

| Total Number of App Downloads | 1M+ |

4. ET Money

ETMONEY is a project of the TIMES NETWORK, one of India's largest media companies, that seeks to make mutual fund investing in India easier than it has ever been.

Both rookie and expert investors will benefit from the best mutual fund app. The app's insightful posts have proven to be incredibly beneficial to all types of investors.

Furthermore, India's best mutual fund app is built on a fully automated functionality that makes investing in mutual funds a breeze. It provides personalized investment roadmaps meticulously tailored to your financial goals and obligations.

You also have access to various financial services, including term and life insurance, several sorts of loans, mutual fund investments, and more.

ET Money, India's top mutual fund app, has the following features:

- Integration with various UPI systems is quick and secure.

- Investing in mutual funds at no cost

- There is a large selection of mutual fund options to pick from.

- Expense Tracker and Monthly Saver by ETMoney

- Gold Deposit with ET Money

| Google Rating | 4 |

| Total Number of App Downloads | 5M+ |

5. myCAMS

myCAMS is one of the simple programs on this list. Thanks to its small file size and simplistic interface, everything is directly in front of you. So, rather than perplexing you, myCAMS gets right to the point and simplifies mutual fund investing for you.

Furthermore, it is feature-rich software, despite not being significantly beautified. There is a PIN and Pattern function for logging in.

You can then look at your MF portfolio or create new folios. Furthermore, you can effortlessly set up your SIP, purchase, switch, and do whatever you want, all without interruption.

The app has the following features:

- There are no additional fees or brokerage commissions.

- Quick assistance with loans and insurance plans

- Investing in mutual funds is simple.

- Systematic Investment Plans allow you to invest in mutual funds (SIP)

- As well as the possibility of making a lump-sum investment

- Investing in an ELSS plan can help you save money on taxes.

| Google Rating | 4.3 |

| Total Number of App Downloads | 1M+ |

6. Cashrich

CashRich is India's best mutual fund app that offers a Dynamic SIP option that provides higher returns than traditional SIPs. CashRich is India's most incredible mutual fund app because of this outstanding feature.

Before February 2020, investors put about 10% to 20% of their money into the stock market. The equity allocation soared to 70-80 percent when the stock market shrank last year owing to the coronavirus pandemic.

As a result, it mitigated the risk of weakening and allowed customers to invest at lower prices in a recession.

The app has the following features:

- Chat accessibility with a single swipe

- Select from the top mutual fund schemes available.

- Investment options depending on objectives

- Accounts with no fees for the rest of your life

| Google Rating | 4.9 |

| Total Number of App Downloads | 100K+ |

7. Groww

Groww is another program that is used to make investments. However, if you're new to mutual fund investing, I recommend using it. This simple program offers minimum features that allow you to make decisions and arrange your finances without difficulty.

It features a single dashboard where you can keep track of all your assets, annual returns, etc. To enroll on the app, you have to receive an account verification via KYC, and you're ready to go.

Special features of this app are:

- The software doesn't charge you a brokerage fee.

- There are no fees associated with opening an account with the application.

- It offers a dashboard that lets you track your investments, annualized returns, and total returns.

- The availability of several learning videos and blogs made and authored by specialists to assist newbies makes the program excellent for beginners and newcomers.

- You can keep track of your performance using the app's one-stop portfolio insights.

| Google Rating | 4.5 |

| Total Number of App Downloads | 10M+ |

8. SBI Mutual Fund

If you're looking for an app to invest in or administer SBI mutual funds, this InvesTap Mutual Fund App from SBI is a one-stop shop. This program makes it simple and convenient to invest, redeem, or switch from one mutual fund to another.

It also allows you to track your investment performance and browse all the accessible funds if you choose to invest shortly.

Special features of this app:

- Simple to Use

- Make a list of your favorite transactions.

- Investment options are numerous.

- Online registration is available.

- SIP Calculator

- Weekly SIP

- Market updates and live quotations

- In-depth stock analysis

- Customized market surveillance

| Google Rating | 4.2 |

| Total Number of App Downloads | 1M+ |

9. Upstox

It is a budget stockbroker situated in Mumbai. It provides traders in the Indian stock market with a fast, reliable, and simple-to-use trading platform.

It is RKSV Securities' online investment brand. RKSV is a Mumbai-based SEBI-registered financial services business that was founded in 2009.

Online stock trading, commodities trading, currency derivatives trading, mutual funds trading, and demat account trading are available through RKSV. NSE, BSE, MCX, NCDEX, NSDL, and CDSL are all members of RKSV Sec.

Upstox is a low-cost trading platform. The consumer is offered free equity delivery (cash & carry) trading. For orders placed in this sector, there is no brokerage fee. Upstox charges a fixed Rs 20 per trade fee for all other trading sectors across exchanges.

Special features of this app:

- The company is the world's second-largest bargain stockbroker.

- As of November 2018, over 1 lakh customers and daily revenue of Rs 15 crore.

- Since 2009, we've been providing low-cost brokerage services.

- Provide a simple trading plan with a fixed rate (Rs 20 per executed order).

- In intraday, you can get up to 20x leverage.

- All customers have access to a free in-house trading platform.

- In less than an hour, you can start a paperless account.

| Google Rating | 4.4 |

| Total Number of App Downloads | 5M+ |

10. KFinKart App

The KFinKart App is a top mutual fund app in India that changes how people invest in mutual funds. There are various reasons to invest in mutual funds using this fantastic app, from a single-dashboard portfolio view to profile-based investment ideas and paperless transactions.

Special features of this app:

- For convenience of use, the navigation is advanced.

- Option to log in using Facebook or Google.

- Check the status of your transaction.

- Linking family portfolios is an option.

- A diverse array of mutual fund strategies

| Google Rating | 4.5 |

| Total Number of App Downloads | 1M+ |

In Conclusion

We sincerely hope that these applications will assist you in the same way they have for us. So, what exactly are you waiting for? Now is the time to dive into mutual funds and save your hard-earned cash.