Do you ever write cheques? Most individuals consider it a simple activity that doesn't matter. But whenever you draw a cheque for any reason, there are a few precautions that you should constantly keep in mind.

The current date, recipient's name, numeric and alphabetic amount value, and other details should be checked appropriately and typed. If you don't take caution when writing a cheque, it could cause panic, and someone could use it against you.

Users can execute transactions securely using financial instruments like cheques. The bank may reject or not honour these cheques if they are not properly drafted. Processing a cheque can be challenging if there is any default or overwriting problem.

As a result, you must be knowledgeable about a cheque's parts, the parties involved, and how to write a cheque in India to manage one effectively.

The most typical payment method is a cheque, particularly when the sum exceeds 20,000 Indian rupees. For lower sums, though, a cheque is also an option.

Businesses utilise this procedure, which was used before the development of online payment applications and is more akin to a dated promissory note, to make payments on a future date. Therefore, understanding how to fill a cheque to someone is crucial.

In cheque transactions, who are the parties?

In transactions involving cheques, there are three parties:

- A drawer is an individual who issues or draughts the cheque.

- A financial organisation called Drawee connects the drawer and the payee.

- Payee: A person or organisation designated to receive the funds shown on the cheque.

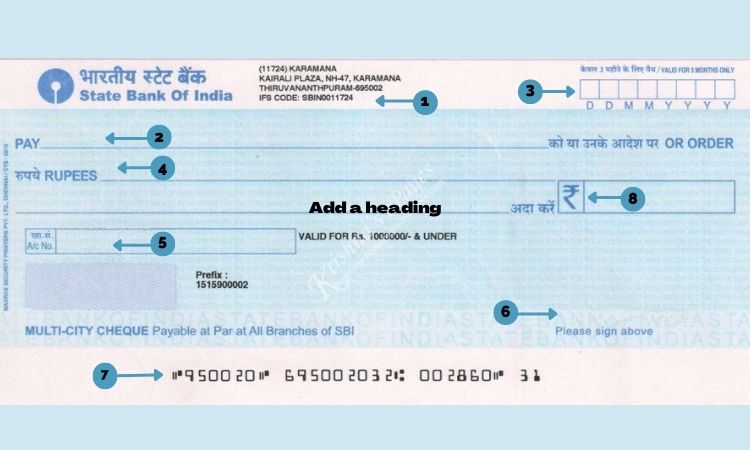

What Components Make Up a Cheque?

Information about the bank is included on the cheque, along with the bank's name and address.

- IFSC: It is a special 11-digit code made up of a combination of letters and numbers.

- Payee information: Make sure that you have written the payee's name correctly here.

- Date box: Complete this box with the day, month, and year.

- Rupees: The drawer must type the amount in words here in rupees.

- Account Number: The account number must be noted on a cheque to process a payment.

- Signature: The drawer must correctly sign the cheque in the space provided. Nowadays, the drawer's name is printed on most bank cheques, but his or her signature is still necessary. Some cheques identify the amount to be transferred as the maximum that can be drawn.

- Cheque number: Each cheque has a special cheque number and a MICR code.

- Amount: The drawer must use numbers to enter the amount transferred in this box.

How To Write A Cheque in India

Generally speaking, a cheque is written in two parts:

- Writing the cheque

- Recording the transaction

Part 1: Prepare the Cheque

If a cheque is not properly written, the bank may reject or dishonour it; therefore, it is essential that the cheque contains all relevant data. Write a cheque by following these easy steps:

Dates should be written in the following format: “DD/MM/YYYY” at the upper right corner of the cheque.

After that, you must write down the ‘Payee's' name. A payee might be either a person or a company.

Now enter the figure in words in the “Rupees”-designated field. Do not forget to write “only” after the entire amount. Write the amount starting from the very left side of the slot.

The cheque will be protected from tampering in this way. For instance, if the total is 5005, write it as “five thousand and five only.”

Write the same amount in numbers in the box on the right side of the cheque once you have put the amount in words. Put the sum in the following format: “5005/-“

The cheque must be signed. The signature you used for other banking procedures should also be used here. The cheque is cancelled if the signatures are incorrect or inconsistent, or they can be proven invalid.

Part 2: Document the Payment

It is advised that every aspect of the drawn cheque be documented because doing so makes it possible to calculate the total amount paid to the payee and the total number of cheques issued.

You won't forget the specifics of the cheques you've written if you do it this way. Keep the following in mind when entering the cheque information:

- Fill out your cheque register book completely with each cheque's data.

- Include the amount, the date the cheque was drawn or issued, and the cheque number.

- An overview of the payee.

Enter the information on a spreadsheet if you don't have a cheque register book.

Also read: Best Virtual Credit Cards In India

Guidelines for Writing a Cheque:

1. Use a Pen

Make use of a pen with blue or blank ink. If you write with a pencil, anyone can change the data and make it simple to steal. Consequently, using a pen to write is advised.

2. Writing a Values Essay

You must write the amount precisely and legibly to prevent stealing and changing. Try to write a number primarily on the left side. Once the quantity has been written, draw a line to prevent additions.

3. Comparable Signatory

A different sign should not be used to sign the cheque. The bank will not accept the statement if you or someone else does this. This protects the owner of the cheque from fraud and abuse. Maintain consistent cheques as a result.

4. Cheques with a Carbon Copy

In some chequebooks, you can discover carbon paper between the actual cheque and the possible cheque. These chequebooks make it simple to keep track of your expenditures without a chequebook register.

Do Not When Writing Cheques:

1. Blank Cheques

Fill out the blank cheques with all the necessary information. Your cheque will be deemed illegal or in the wrong hands if you skip any columns or lines when filling them out. Before sending the cheque, double-check the information you've filled out.

2. Steer Clear of Writing “Cash” on Cheques.

Anyone may utilise the cheque if “CASH” is written in front of the payee line. Therefore, avoid making the cheque payable in “CASH.”

3. Never Submit a Cheque Without First Checking it:

After writing a cheque, you are not allowed to make any changes. Cross-check the information that has been filled out to make the transfers simple and hassle-free.

4. Don't Misplace Your Cheque:

Store your cheques and chequebooks in a secure location. Report the loss of a cheque right away to the bank. All remaining cheques will be frozen and cancelled by your bank.

FAQ's

1. When does a cheque become effective?

In India, the time it takes for a cheque to clear after being deposited into a specific credit union account is three working days. However, this time frame may be extended in some circumstances. It's crucial to realise that you won't be able to withdraw the requested amount until the cheque has cleared.

Customers have the option to request a special clearance from several banks. Under this procedure, a special clearance fee could apply, and the bank would estimate the time needed for the money to clear.

2. How do I stop a cheque from being paid?

You can halt the payment on a cheque in a few different ways.

- You can phone the bank and provide enough information for them to identify the cheque.

- Send a letter to the bank containing all the information needed to identify the specific cheque.

- Most banks only accept written letters if you want to stop paying on any deposited cheques.

3. How can the risk of fake cheques be reduced?

- Begin writing the cheque with the recipient's name immediately after the term “Pay,” as shown;

- Write the number in words using capital letters as close as you can.

- Make sure you don't leave too many wide open spaces between letters that could be filled with more.

- After mentioning the sum, use the word “only” in writing.

- Avoid placing spaces between the amounts represented by integers.

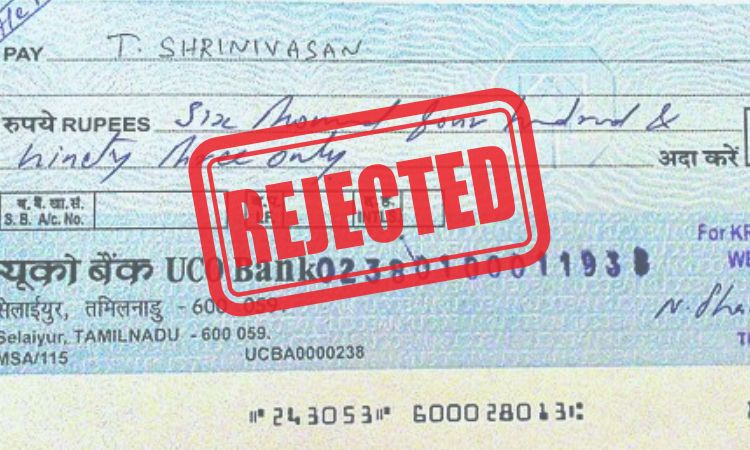

4. When is a cheque dishonoured or not processed by a bank?

A bank may refuse your request for a cheque under several circumstances. Your predicament can get worse if your cheque routinely “bounces”. Try to take specific precautions to maintain your transactions' efficiency to avoid this issue. Some of the reasons a bank might refuse to honour a cheque are:

- The bank is unable to cash the entire cheque since there isn't enough money in your account;

- The bank is still unaware of the precise purpose of the cheque because it was not properly filled out;

- The cheque is out of date since it has a date that is more than three months old;

- Cheques that have a different issuer's signature will bounce.

- Cheques presented to the bank that is scrawled or have been overwritten are typically rejected.

Conclusion

The article attempted to provide a piecemeal explanation of the entire filling of a cheque process. The act of writing a cheque to someone may appear simple. A cheque, however, consists of several separate components.

Whether it is a personal or business account, always check the readability of your cheques twice. Maintain the cheque's component parts as described in this article and take the appropriate safety precautions. Before delivering a cheque, always take your time and double-check your work.