“Money is honey my dear sunny and a rich man’s Joke is always funny”.

- Do you want to create, earn millions even billions scientifically?

- Do you want your money to work for you smartly all the time?

- Do you want to secure your future?

Then, you are welcome enter this most lucrative, Rational World of Wealth wise, Moneywise.

Why smart investment? Wealth Management?

Money has been always important, much more so in this era of globalization, privatization, hire and fire policies of the organizations.

In this age of cut throat competition, cost of living is increasing, pension is disappearing and so are the jobs due to automation, Artificial Intelligence etc.

It has become extremely important and essential for anybody and everybody to make wise, Smart Investments which can drastically better your future.

What is No. 1 enemy of Investment?

If you do not invest wisely and smartly, whatever may be your income, your assets, because of inflation at best your savings, assets will grow marginally and at worst they will keep decreasing year after year.

This worm of Inflation bleeds your purchasing power.

To maintain reasonably good life style now and even in old age one must generate good returns, well above rate of inflation.

Wealth and good returns do not come from thin air, nor created by magic wand, but are only possible by application of knowledge, logic, expertise, decades of experience.

It requires proper investment of mind and money.

By applying my expertise, experience, and knowledge rationally step by step, I will make this whole Universe of investment clear to you for creating wealth.

This is my promise.

Investment Scenario

Everyday we see many so called experts on TV, read them in print, hear them in seminars making conflicting claims. They simply create confusion in our minds regarding investments and wealth creation.

a) The Traditionalist, Goldsmiths have always said Silver and particularly Gold has been always a great investment around the world from the dawn of civilization.

b) Builders, Architects say Real Estate is always the safest and best investment.

c) The fashionable, rich say buy paintings and antiques and grow your wealth.

d) The Jewelers, Super rich say diamonds are a woman’s best friends. Diamonds are forever.

e) Stock Market Brokers, Experts say many studies around the world have shown that over a long period of time, equities have always out performed all other assets.

f) The technosavy say it is time for Carbon Credits and all others have become redundant.

g) Some Promote commodity trading while others propagate derivatives , still others promote Forex.

Really all confusing, given such an array of options! Is it not?

Then what is the truth? Let us find out.

None of these so called experts provide any logical, scientific explanation in support of their favorite assets.

The most basic question comes to our mind is –

“Is there or can there be an investment asset or assets which can be called intrinsically, logically, fundamentally the best?”

Let us see.

Romancing the Assets

To find the truth, we first flirt – in Part A and then indulge in serious romancing – in Part B, with the assets. I mean we will understand the basics in part A and then take a deep drive in Part B.

Thus, we will peep deep into the hearts and souls of all assets. We will do all the soul searching to find the soul mate if any.

Insights in to Different assets:

Let us understand different assets with single liners.

1) Debt – It has an important point to prove

2) Diamonds – Diamonds are forever. Diamonds are woman’s best friend

3) Commodities – A Chita amongst Chitals

4) Paintings/Antiques – A thing of beauty is joy for ever.

5) Carbon Credits – Technology on the blocks

6) Forex – Formula 1, fastest on the tracks.

7) Derivatives – Forbidden fruit

8) Gold – Gold always glitters.

9) Silver – Every clouds has got silver lining.

10) R.E. = Real Estate – Always the safest & the best investment

11) Equity – A cat amongst the pigeons

To reach a correct, scientific conclusion, we will further dissect the entire range of assets, inspect their insides, heart souls, core values, then analyze, compare them rationally in all possible ways.

We will examine how the assets exist, function, perform?

When and How their prices change?

Whether the assets are Static or Dynamic? Passive or Active?

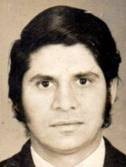

Dilip Kelkar is a Civil Engineer from VNIT Nagpur and a National Merit Scholar. He also holds an MBA Degree.

He has over 4 decades of wide and varied experience in diverse fields like Infrastructures Rating, Management Consultancy, Sports Tourism and Wealth Management around the globe in top Government and MNCs.

He is an expert in Wealth Management. Equity and Real Estate Investment has been his passion right from College days in 1970s.

He has been delivering many pragmatic lectures on Wealth Management in premier Institutes like IIMs, ICAI, Chambers of Commerce, Persistent, L & T, and Siemens etc.

He has designed and taught 50 Hours course on Wealth Management for IIM and other Graduates. He has many unique Copy Righted Articles on Wealth Management.

He is a real expert with crystal clear concepts and provides advisory, consultancy services on all aspects on Wealth Management.

He can be contacted at:

- 0712-2245739

- 9890488657 / 9421370335

- [email protected]/ [email protected]