Most of us working on a salary often find it hard to find the money for urgent expenses during the last week of the month, as we fail to save money from salary.

This was my situation when I was working. At the end of the month, I had to count the change left in my pockets, purse, drawers and other places to pay for something.

This would make me wonder every month, where does my salary vanish? I would get the amount of money my employer and I had agreed on as a salary.

Of course, there were a few small tax deductions, but I knew how much I was getting. I know that my employer was paying me the correct amount because my salary and all other income, such as allowances, would go directly to my bank account every month.

So, how to save money from your salary?

After thinking this way for several years, I decided to check why I fell short of money each month. And I discovered some of the strangest ways that would make my salary vanish every month.

My salary wasn't vanishing by any magic. I was spending it carelessly and without maintaining any accounts. Hence, it would vanish without me knowing where all that money went.

If you're also experiencing the same problems as me, I suggest you check these points I will discuss now. I am confident that these are the places where most of your salary vanishes every month.

Most Common Places Where Salary Vanishes

Actually, your salary doesn't really vanish. As I said earlier, you only imagine the money has gone away too quickly. In some cases, you have wasted a lot of money, which I can confidently tell you.

So, listen carefully and make a list of the things that I will be talking about now.

Refer: Know Your Pay Slip

1. Groceries on Credit

Buying small quantities of groceries on credit from your neighbourhood store is the biggest culprit for your money to vanish. This happens because we buy a lot of stuff in small quantities since we don't need it frequently or want something immediately, especially while cooking.

It could be anything from a packet of salt or a few biscuit packets to serve some unexpected guests with tea. We would usually send our kids, or any of us spouses would rush to the store to buy these things. And since the storekeeper knew us very well, they wouldn't ask for cash immediately.

Buying such small amounts of groceries on credit is a common practice all over India, especially if you have a kirana store just around the corner and you know the storekeeper or their employees. They will simply write down the amount you have to pay in a notebook or on a piece of paper and will give it to you at the end of every month or when they want the money.

What happens? Usually, we forget whatever we have bought from the store. And when the storekeeper presents us with the monthly bill, we pay blindly. Those who check the bill won't usually remember whether they actually ordered or bought such things.

In some cases, a shopkeeper might add a few things by mistake or, in some cases, even deliberately, to make extra money. This doesn't mean that every shopkeeper is a cheat, but they're such cases too.

The other biggest culprit is sending kids to buy such small amounts of groceries and allowing them to purchase chocolates or sweets or whatever they want. Often, kids misuse this facility and buy a lot. And in most cases, they forget what they bought and don't even tell their parents. Because parents don't wish to know.

Therefore, small groceries on credit could be one of the darkest places where your salary vanishes every month.

2. Tea, Coffee, Soft Drinks, Tobacco, Snacks

We Indians are huge consumers of tea and coffee as well as soft drinks. Some of us also eat Pan or chew tobacco. Then we have this habit of snacking between meals or in the evenings while free or returning home from work or at any time of the day.

There's nothing wrong with this. In fact, if these things help you live a better life, you should continue. Understandably, tobacco use comes with risks of cancer and other diseases, so they are best avoided.

Personally, I don't smoke or consume a lot of tea or coffee or chew tobacco or even have a soft drink. Nor do I have the habit of snacking between meals. But, should you be doing such things, I would ask you to watch out. A cup of tea or coffee with a friend or colleague, a snack at the roadside stall or sharing a smoke or pan and other stuff costs money.

It doesn't cost much money when you spend it on a daily basis. Calculate all the money you're spending on those extra cups of tea or coffee, smokes or chewing tobacco, snacks on the way and other stuff for a month. You will surely be shocked at the large amount you spend every month.

For obvious reasons, we don't keep records of such minor expenses. That's how we lose account of how much money we spend on such stuff till it's too late, such as at the end of the month. These expenses can be very high if you have kids because they would want to have snacks frequently and enjoy a soft drink too.

3. Subscriptions

An average Indian has at least five to seven subscriptions for which they spend money every month. In some cases, you could also have more than seven subscriptions and are paying for them.

Some of the common subscriptions in India include cable TV or satellite TV, landline telephone, newspapers and magazines for the family, Amazon Prime or other such paid loyalty programs, gyms and clubs. Overall, these may appear as small amounts of money. But when you pay them and add them up for a few months or a year, these small amounts sum up to a grand total.

Most Indians spend anything between Rs.500 and Rs.6,000 on monthly subscriptions for various things. This amount can go higher too. Usually, some organizations charge you a lumpsum quarterly or annual subscription rate by offering discounts and freebies.

For example, you can get a few days of viewing extra if you pay for your cable TV packages or satellite TV channels in advance. Gym memberships and newspaper and magazine subscriptions are also cheaper when you pay a year in advance.

If you take a look at all these subscriptions, I am sure that you'll find that you're using barely 50 per cent of the benefits they offer. For example, you wouldn't be watching the TV channels from your packages frequently or even reading newspapers daily. Some people pay an annual membership fee for a gym but stop going after a couple of months.

While some of these expenses are justified and hence, unavoidable, others are absolutely useless expenses. If you review all such subscriptions carefully, I am confident that you'll find all the places where you're losing money. Therefore, this is one more dark area where your salary vanishes every month.

Refer: Make Extra Money with These Money Earning Apps

4. Transportation Costs

Sometimes, we miss the bus or train or the company transport because we're late to arriving at the bus stop or station. And occasionally, there're issues with public transport or company transport. What happens? We're anxious not to miss the day's work, especially since we're prepared. Therefore, we rush to our office or workplace by hiring a taxi or rickshaw.

Hiring a taxi or rickshaw is also common when we're returning late from someplace or have to carry heavy stuff like our monthly groceries from the store to our homes. We use such forms of transport frequently when doing some personal work during office hours.

Though a lot of us have vehicles such as a scooter, motorcycles or cars, we don't really use them in such cases due to reasons ranging from the high cost of petrol or lack of parking space, especially near crowded stores.

If you have school-going kids, then you would definitely be paying for their school bus unless someone else does the job of dropping them off and fetching them from school. Or, you're doing it with your own vehicle.

Again, all these expenses are necessary in most cases. But such additional costs on transportation are one more place where your money could vanish. Like with every other expense, these costs seem minor and affordable. Yet, adding them up shows how much excess money you're spending from a salary.

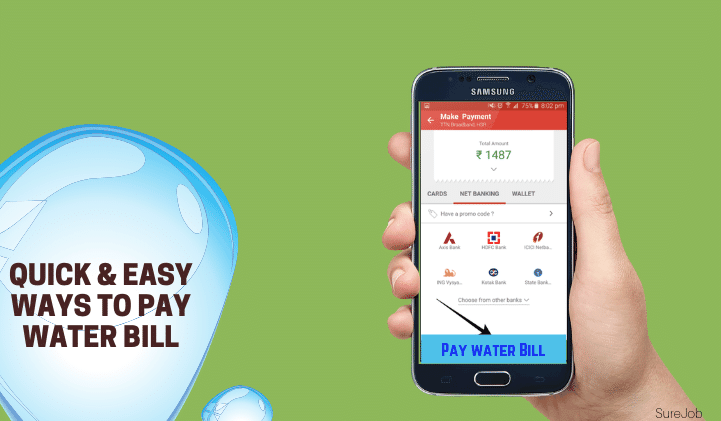

5. Electricity, Water and Mobile Phones

If we notice carefully, you'll surely see that we're consuming more electricity nowadays than, say 10 years ago. And there's also been a tremendous increase in the charges for electricity and water supply. This means there's a two-way increase in the amount of money we're paying to utility providers.

The higher expenses on electricity happen because most households have gadgets such as washing machines and microwave ovens, large TV sets that consume more electricity and even air conditioners that are known to be power guzzlers.

Then we have mobile phones, laptops and computers that run on electricity. While laptops and mobiles have batteries, we have to recharge them frequently.

Normally, most of us never notice a slight increase in the electricity bill. We take it for granted, assuming that we might have consumed more during a particular month without even knowing the reasons for this surge in usage. And we pay the bills blindly.

Worse, a lot of us are reckless about the way we use electricity. Leaving lights on when not necessary or allowing appliances to run unattended or without need are also some of the causes of higher bills.

Since we can't live without electricity and water in today's world, some expense on utilities would be justified. However, this is one more place where your monthly salary vanishes.

Also read: Great Ways For Energy Conservation And To Save Electricity At Home

6. Mobiles and Internet

The fact that you're watching my YouTube channel on a computer or mobile shows that you're connected to the Internet. Most of us nowadays have high-speed Internet at home for ourselves and our families.

During and after the Covid-19 pandemic, the Internet has become a part of our life, especially if you're working from home.

We use the Internet in two ways- either from our laptop or PC or through a mobile call and data plan. Both these cost us some money. To get Internet at home, you must pay the service provider a monthly fee. To use mobile data, we pay telecom companies for packages that come bundled with free calls and SMS messages.

It's common nowadays for people to own two or even more mobile numbers. Regardless of how many mobile numbers you own, it is necessary to recharge them regularly if you wish to stay connected.

These are some of the unavoidable expenses for any modern Indian household, regardless of their total income. That means, whether you're poor or rich, you will need these services and need to pay. Therefore, you can consider these expenses as another place where your salary vanishes every month.

7. Liquor, Dining and Entertainment

An occasional drink at home or a bar and restaurant, dining with family or friends and entertainment such as cinemas or attending parties and such things are part of every Indian's life. These are healthy for our minds too since they relieve stress in total moderation.

But calculate the expenses. Though India is one of the countries with the lowest prices of alcohol, the cost is high when we consider our monthly income.

Dining outside with a family at a good restaurant or ordering home delivery or takeaway food is also quite pricey. Attending parties and weddings, or other special occasions entails gifting.

These, too, are unavoidable expenses. Yet, we don't consider them; hence, our salary vanishes here too.

8. Absence of Accounting and Budgeting

The greatest thief of your money is your inability and negligence of accounting and budgeting. You find that your salary vanishes every month because you do not have a proper budget. And nor do you keep accounts.

Making a proper budget and sticking with it is the best way to prevent your salary from vanishing every month. And maintaining accounts is the surest way to prevent unnecessary monthly expenses from eating up your salary.

Both accounting and budgeting can help you gain some control over your money. You could have enough money at the end of the month and will be able to overcome any hassles should your salary get delayed for any reason. With proper accounting and budgeting, you can save and invest a lot of money for growth.

In Conclusion

These eight factors cause your salary to vanish every month. I learned it the hard way when I found nobody from whom I could borrow money because they also found their salary vanishing every month. Therefore, use these eight points as my guidelines and stop your salary from vanishing every month. It will be worth every single effort. Remember, a penny saved is a penny earned.