A forex card is one of the most generally accepted methods of transporting foreign currency, making it a valuable asset for all travelers. The best forex card can make the life of a student studying abroad easy as it helps to manage their personal finances.

Meaning of Forex Card

A forex card is a type of prepaid credit card that allows you to deposit funds in the local currency of the nation you'll be visiting. You can quickly pay with your card or withdraw cash from ATMs. You won't have to worry about carrying cash everywhere, and it's a safer alternative.

Forex cards are one of the finest ways to spend your money intelligently when traveling overseas. These cards are secure and can be used to substitute cash at a lower cost.

If you utilize a forex card with foreign currencies put on it, it will also assist you to get better exchange rates. The rate of the funds you have put in your forex card remains constant, regardless of whether the forex market rates increase or decrease.

Types of Forex Cards in India

In India, there are two types of forex cards. They are as follows:

1. Multi-Currency Forex Cards: As the name implies, these cards may be loaded with up to 23 different currencies and used worldwide. When traveling from one country to another, it assists you in changing from your current currency to the currency of the country you are visiting.

2. Single-Currency forex cards: This type of card can only be loaded with one type of currency. It can, however, be reloaded as often as the buyer desires. This card comes with a hefty cross-currency charge anytime you use a different currency and limited perks.

What are the advantages of Forex cards?

Given our fear of losing money and the difficulty of handling it when traveling, it is a safe option to manage foreign currency while traveling overseas.

It is less expensive and has fewer fees than credit or debit cards, allowing you to save a significant amount of money. It provides exclusive discounts and benefits, which who doesn't like?

All you have to do is swipe your card to pay for any purchase. Isn't it the most straightforward option? I don't have to count money, for example.

In India, forex cards come with particular benefits, such as no ATM fees, cross-currency fees, and minimal transaction fees. Its properties make it a secure payment mechanism. It is widely accepted all around the world.

Also read: Best Virtual Credit Cards in India

10 Best Forex Cards in India in 2024

Here are some of the best forex cards for students studying abroad and those traveling to a foreign country for vacation.

Read also: 10 Best Cashback Credit Cards in India

1. Axis Bank Multi-Currency Forex Card

One of the best forex cards in India is the Axis Bank Multi-Currency Forex Card. It benefits the applicants because they do not have to recharge their cards with different currencies each time they travel to a new location. This card also serves as a hedge against currency changes.

This card can even assist you in cashing out your funds once you've completed your journey. Contactless technology eliminates the requirement for consumers to make physical contact and allows them to pay just by waving their cards across a contactless scanner.

The following are the currencies that can be loaded:

(HKD) Hong Kong Dollar, the New Zealand Dollar, the Danish Krone, and the South African Rand.

Fees:

- Fees reloaded: Fees for the first year of insurance are Rs 300 plus GST.

- Rs 100 is the reactive fee.

- Cross-currency fees amount to 3.5 percent.

- These cards have a 5-year validity period.

2. YES Bank Multi-Currency Travel Card

Because it is very safe and cost-effective, the YES Bank Multi-Currency Travel Card is also one of the finest forex cards in India.

The good news is that you can quickly manage your card using the customer service portal online from anywhere and at any time. You can also look at the history of your previous transactions.

The following are the currencies that can be loaded:

GBP (British Pound), EUR (Euro), SGD (Singapore Dollar), AUD (Australian Dollar), AED (UAE Dirhams), JPY (Japanese Yen), CAD (Canadian Dollar), HKD (Hong Kong Dollar), CHF (Chinese Franc) (Swiss Franc)

Fees:

- Fees for insurance: Rs. 125

- 100 rupees reload fees

- Validity: 2 years, and users can reload it as often as they like.

3. HDFC Multi-Currency Forex card

One of the most popular Forex cards on the market is the HDFC Multi-Currency Forex card. It has a total of 22 currencies available on a single card.

These cards have characteristics such as the ability to shuffle cash between two distinct currencies, as well as being contactless, and offering supplementary insurance and concierge services. They also protect users from currency swings in the forex market.

Customers are also entitled to compensation of up to Rs 5 lakh if their data is misused.

The following are the currencies that can be loaded:

Euro, Oman Riyal, Korean Won, United Arab Emirates Dirhams, Japanese Yen, Saudi Riyal, Sterling Pound, Malaysian Ringgit, Norwegian Krone, Swiss Franc, Thailand Baht, Danish Krone, Swedish Krona, South African Rand

Fees:

- Fees: 500 rupees plus GST for issuance.

- Reloading fee: Rs 75 + GST

- Charges for currency conversion: 2%

4. IndusInd Bank Multi-Currency Card

The IndusInd Bank Multi-Currency Card is well-known among regular travelers. This card comes with 14 different currencies and other features like no international markup charges and the ability to use it online. Customers can obtain up to two free ATM withdrawals monthly as part of the package.

The following are the currencies that can be loaded:

Euro (EUR), Singapore Dollar (SGD), British Pound (GBP), Saudi Riyal (SAR), US Dollar (USD), Canadian Dollar (CAD), Australian Dollar (AUD), Euro (EUR), British Pound (GBP), United Arab Emirates Dirham (AED), Euro (EUR), British Pound (GBP),

Fees:

- Fee for issuing a single card: Rs.150 plus GST

- Fee for issuing a paired card: Rs 250

- Fee for reloading: Rs.100 plus GST

- Cross-currency fees are 3.5 percent.

5. Thomas Cook Forex Card In India

Thomas Cook is a well-known travel company in India that also offers currency cards. You can even send money abroad with their card, which comes in nine different currencies.

It is a well-known brand that offers insurance coverage of up to $10000. Additionally, toll-free customer care is provided on internet platforms to assist with checking balances, statements, and card blocking.

The following are the currencies that can be loaded:

Dollars, Euros, British Pounds, Swiss Francs, Canadian Dollars, Singapore Dollars, and Japanese Yen are all examples of currency.

Fees:

- The issuance fee is Rs.150 plus GST.

- Fee for reloading: Rs.100 plus GST.

6. ICICI Bank Forex Prepaid Card

If you wish to travel to a specific place or destination, the ICICI Bank Forex Prepaid Card is a perfect option. It is adaptable to your travel schedule. This card may be reloaded at any ICICI FX branch, over their online platform, or through their mobile app.

It also offers discounts of up to 20% on restaurant bills, shopping, and a variety of other outlets throughout the world.

They also offer up to Rs 10,00,000 in insurance coverage. No savings or current accounts are necessary to open this account with ICICI bank, and the card is delivered in just two days.

The Exchange Rates The ICICI Forex Card allows you to load a variety of currencies:

Euro (EUR), Swiss Franc (CHF), Japanese Yen (JPY), Swedish Krona (SEK), South African Rand (ZAR), Saudi Riyal (SAR), Thai Baht (THB), New Zealand Dollar (NZD), Hong Kong Dollar (HKD), US Dollar (USD), Singapore Dollar (SGD), British Pound (GBP), Australian Dollar (AUD), Arab Emirates Dirham (AED), Canadian Dollar (CAD), Euro (EUR), Swiss Franc (CHF) (HKD)

Fees:

- Fee for issuance: Rs 150 (One time)

- Fee for reloading: Rs 100

- Fee for Reaction: USD 5 (for every 180 days of inactivity)

- 3.5 percent cross-currency fee

7. SBI Multi-Currency Foreign Travel Card

When it comes to forex cards in India, the SBI Multi-Currency Foreign Travel Card is one of the safest and wisest solutions. It can be loaded with seven different currencies from various nations.

Because it has the MasterCard Acceptance Mark, you can use it for various payments, such as restaurant bills, shopping, dining, and other lodging bills anywhere in the world. It is accessible 24 hours a day, seven days a week, worldwide.

The following are the currencies that can be loaded:

US Dollars (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (YEN), Saudi Riyal (SAR), Singapore Dollar (SGD)

Fees:

- Fees for insurance: Rs 100 plus GST.

- Fees for additional services are Rs 100 plus GST.

- Reloading costs Rs 50 plus GST.

8. Axis Bank Diner's Cards

Applicants for Axis Bank Diner cards can only load USD. They sell gift cards that offer you 2 points for every dollar you spend, up to $5. Additional advantages include medical care and up to Rs 60,000 in compensation for ATM robbery.

Users can transfer their balances to their domestic accounts at any time.

Fees:

- The cost of activating a card is Rs 150 plus GST.

- Reloading fee: Rs 100 plus GST

- The fee for an add-on card is Rs 100 plus GST.

9. HDFC Bank ISIC Student ForexPlus Card

As the name implies, the HDFC Bank ISIC Student ForexPlus Card was created to assist students with their identity cards. It comes with many other perks, like discounts on books, travel, and more in more than 130 countries.

Baggage loss costs over Rs 50,000, while passport restoration costs around Rs 20,000. Customers also receive a complimentary international SIM card with a talk time of Rs 200 that may be used up to 60 days before their trip.

The following are the currencies that can be loaded:

Dollars, Euros, and Sterling Pounds

Fees:

- Card Issuance Fees: Rs 300

- Fees for reloading are Rs 75; fees for re-issuing are Rs 100.

10. Niyo Global Card

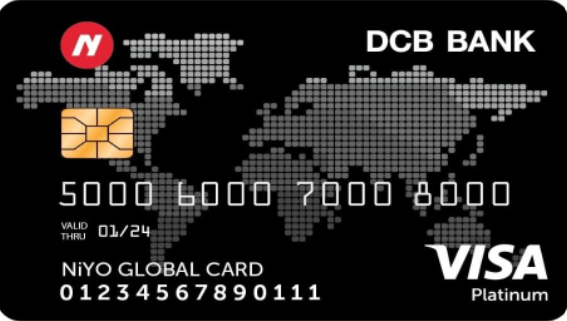

According to one of the biggest travel businesses, the Niyo Global Card is the greatest and most well-known currency card. This has been published with the assistance of DCB Bank.

Furthermore, their mobile application makes it simple to use, and you can even lock the card while it's not in use.

Fees:

- Fees for joining and renewing are both Rs 0.

- Withdrawal from an ATM: nil.

In Conclusion

With time, forex cards are becoming increasingly popular in India. A forex card is a godsend for all travelers, providing them with a cost-effective and convenient means to make payments.

With their added benefits, it's a deal you shouldn't pass up if you're a travel enthusiast who enjoys exploring new places.

Finally, make your travel experience pleasurable and tailored to your needs with features such as a single currency card for travel within a single nation, multi-currency forex cards for travel across many countries, and add-on bonuses.