What is a Debit Card?

When you open a bank account, your bank will provide you with a debit card; a debit card is a small plastic card that you can use to make purchases or withdraw cash from an ATM without visiting a bank. When you use a debit card, the funds are immediately transferred from your bank account.

Choosing the best debit card is crucial because it can increase your benefits and enable you to make financial savings. Some debit cards offer cashback on purchases, reward points, free ATM withdrawals, and more. But if you choose the wrong debit card, you could pay high fees or not get any benefits.

Features to Consider When Choosing a Debit Card

A. ATM Withdrawal Charges

The fees for ATM withdrawals should be considered when selecting a debit card.

Some banks may charge fees if you withdraw money from their ATMs, but not all banks do this.

Debit cards that allow free ATM withdrawals from your bank's network are the ones you should pick.

B. Cashback and Reward Programs

Many debit cards have cashback and reward programs that let you earn points or cashback on your purchases. You should choose a debit card with a cashback or reward program that suits your spending habits.

C. Annual Fees and Other Charges

Some debit cards come with annual fees and other charges, such as fees for making online transactions or using your card abroad. You should choose a debit card with low or no annual fees and additional charges.

D. Overdraft Facility

Some debit cards allow you to withdraw more money than in your account by offering an overdraft feature.

This can be helpful in an emergency, but it may also have expensive fees and interest rates.

Look for a debit card with a good overdraft facility or none.

E. Other Benefits

Apart from the above features, some debit cards offer other benefits like travel insurance, free movie tickets, or discounts on dining and shopping. Choose a debit card that offers benefits that suit your interests and lifestyle.

Top 20 Best Debit Cards In India

1. Axis Bank Prime Titanium Debit Card

The Axisbank Prime Titanium Debit Card is a popular basic debit card provided by Axis Bank. It allows for easy and hassle-free transactions, making it an ideal option for those who are always on the go.

With several perks like reward points and insurance coverage, this card is a great choice for those looking for a reliable debit card.

Features:

- Anyone, anywhere, at any time, can create a debit card PIN.

- Rs. 50,000 maximum for ATM withdrawals.

- Limit of Rs. 1 lakh on shopping transactions.

- Create your own look with MyDesign by printing the image of your choice on your card.

- eDGE Loyalty Rewards Program for purchases, card swipes, etc.

- 3 lakhs of insurance coverage in case of accidents or fatalities.

- The substantial daily cap on cash withdrawals and POS transactions.

Fees:

The annual fee for the Axisbank Prime Titanium Debit Card is Rs. 150 plus taxes.

2. SBI Platinum Debit Card

SBI Platinum Debit Card is a premium debit card from SBI that lets you enjoy cashless shopping while earning SBI Rewardz points for every purchase. This card also offers international usage and insurance coverage against accidental death.

Features:

- Earn 1 SBI Rewardz point for every purchase of Rs. 200/-, which can be redeemed for gifts.

- Five lakh rupees' worth of accidental death insurance.

- International usage lets you travel the world and transact anywhere using this card.

- Associated with VISA and MasterCard.

- Daily purchase limit of Rs. 2 Lakhs and withdrawal limit of Rs. 1 Lakh.

- Complimentary airport lounge access is subject to terms and conditions.

Fees:

Annual fee of Rs. 175 + GST

Issuance fee of Rs. 100 + GST

3. HDFC Bank RuPay Premium Debit Card

The HDFC Bank RuPay Premium Debit Card is one of the best Rupay-powered cards available in India. It is ideal for online purchases on Indian websites, and after connecting to PayPal, users can even make purchases on international eCommerce websites.

This HDFC debit card offers a high purchase limit for online and PoS terminals and provides exclusive Rupay benefits on various online shopping sites.

Features:

- Discount offers on different eCommerce sites.

- High online purchasing limit of up to Rs. 2.75 lakhs.

- Cashback offers include 5% cashback on utility payment bills for selected sites and cashback on railway ticket booking.

- Users of this card receive two complimentary lounge passes at various airports.

- Low renewal fees for ATMs.

- Suitable for grocery shopping, utility bills, and online payments.

Fees:

- Annual Fee: Rs. 200 + GST.

- Replacement/Reissuance Charges: Rs. 200 + applicable taxes.

- ATM Pin Generation: Rs. 50 + applicable charges.

- Daily Domestic ATM Withdrawal Limit: Rs. 25,000.

- Daily Domestic Shopping Limit: Rs. 2.75 lakhs.

4. Kotak Bank PayShopMore International Chip Debit Card

This debit card from Kotak Mahindra Bank is a feature-rich card powered by Visa that offers many online purchasing offers on Indian sites. It allows for international transactions and cash withdrawals anywhere in the world.

Features:

- Lost card protection of up to Rs. 2.50 lakhs

- Online payment protection of up to Rs. 50,000

- Cashback offers

- Customizable card design

- Free access to domestic and international airport lounges

- Suitable for travel and online purchasing

Fees:

The annual fee for this card is Rs. 750 plus GST.

5. IDFC First Visa Signature Debit Card

IDFC Bank introduced the IDFC First Visa Signature Debit Card after merging with Capital First. An average monthly balance of Rs. 25,000 is required to obtain this card.

Features:

- This card offers a cashback of Rs. 250 per month on BookMyShow when booking tickets using the card.

- Customers using this card can also be eligible for free insurance coverage such as Permanent Disability and Death Insurance.

- Other benefits include a 1% fuel surcharge waiver, no annual fee, and domestic airport lounge access.

Fees:

There is no annual fee for this card.

Also Read:

- 10 Best Virtual Credit Cards in India

- Should I Get A Credit Card?

- 10 Best Cashback Credit Cards in India 2022

- 10 Best Forex Cards in India in 2024

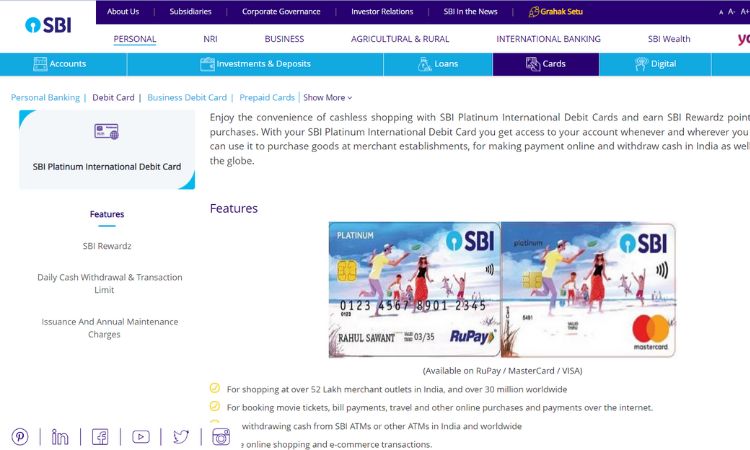

6. SBI Platinum International Debit Card

The SBI Platinum International Debit Card is one of the few cards from SBI that offers international facilities, making it an excellent choice for frequent travellers.

This card has both Visa and Mastercard gateway networks, providing various usage options. With a vast network of SBI ATMs and other banks' ATMs, you can easily withdraw cash from anywhere.

Features:

- This debit card offers high online payment and cash withdrawal limits, making it an ideal choice for heavy users.

- Additionally, selected users can avail of EMI on debit card purchases. The card has a low renewal fee, making it a cost-effective option.

- With the SBI Platinum International Debit Card, you can enjoy free airport lounge access and earn reward points for online purchases.

- This card is accepted at over 52 lakh merchant outlets in India and over 30 million outlets worldwide, making it incredibly versatile. It's also safe to use for online shopping and e-commerce transactions.

Fees:

The annual fee for the SBI Platinum International Debit Card is Rs. 175 + GST. The card also has low renewal charges.

7. ICICI Bank Coral Paywave International Debit Card

The ICICI Bank Coral Paywave International Debit Card is a secure NFC-powered Visa Paywave debit card with contactless payment facilities. This card offers discounts and cashback bonuses on online purchases and merchant shops in India.

It is suitable for online purchasing, international payments, lifestyle maintenance, and travelling. The card also offers Payback reward points for online purchasing. It was the first bank in India to offer a contactless payment facility to its users.

Features:

- The Coral Paywave Debit Card has many benefits, like free movie tickets, access to lounges at different airports, and a fuel surcharge waiver.

- It has a high withdrawal limit of up to 1 lakh at domestic ATMs and up to 2 lakhs for international withdrawals.

- The card also has a high online payment limit, making it suitable for online transactions.

- The Coral Paywave technology enables contactless payments at retail outlets, making it easy and convenient to use.

Fees:

The joining fee for the Coral Paywave Debit Card is Rs. 599 plus GST, which is charged only for the first year. The annual fee is also Rs. 599 plus GST, which will be charged from the second year onwards. If you need to re-issue the card, re-issuance charges of Rs. 200 plus GST will apply.

8. Yes Bank Prosperity Platinum Debit Card

The Yes Bank Prosperity Platinum Debit Card is an exclusive card that provides a range of benefits such as a green fee waiver on golf rounds, a 1% fuel surcharge waiver, instant EMI at over 80,000 stores, and a life insurance cover of ₹50 lacks.

This card offers worldwide access to over 15,00,000 ATMs and contactless payments through a CHIP + NFC-enabled card.

Features:

- Green fee waiver on golf rounds

- 1% fuel surcharge waiver on fuel purchase at any petrol pump

- 4 reward points on spending ₹200

- Instant EMI at over 80,000 stores

- Life insurance cover of ₹50 lakh

- Worldwide access to over 15,00,000 ATMs

- Contactless payments through a CHIP + NFC-enabled card

- Welcome aboard offer of INR 10,000

- Exclusive offers on fine dining, shopping, travel, entertainment, and more

- Earn and redeem reward points on every transaction

- Personal accident insurance up to INR 5,00,000

- 1 complimentary access to domestic airport lounges per quarter

Fees:

The annual fee for this card is INR 599. Cash withdrawal (International) incurs a charge of INR 120 per transaction, balance enquiry (International) costs INR 20 per transaction, and physical PIN regeneration costs INR 50 per instance.

There is also a charge of INR 25 per transaction for ATM decline due to insufficient funds and INR 149 per instance for replacing lost/stolen cards.

9. HDFC Bank EasyShop Platinum Debit Card

HDFC Bank EasyShop Platinum Debit Card is a popular debit card offered by HDFC Bank. It helps customers save money in several ways and offers a range of features and benefits.

Features:

- This card has a high daily cash withdrawal limit of Rs. 1 Lac and a limit of Rs. 5 Lacs for online shopping.

- Customers earn 1% cashback as a reward when they pay using this card online or at any retail store.

- International transactions can be availed once activated using HDFC Bank Net Banking.

- Eligible customers can use the EMI facility from popular eCommerce sites like Amazon and Flipkart.

- Customers can change their daily shopping and ATM withdrawal limits according to their needs by logging in to NetBanking.

Fees:

The annual fee for HDFC Bank EasyShop Platinum Debit Card is Rs. 750 + GST.

10. Indusind Signature Exclusive Debit Card

IndusInd Bank Signature Debit Card is an exclusive card that offers several exciting features and benefits, making it a convenient choice for shopping, entertainment, and dining purposes. With this card, customers can easily make payments and transactions just by swiping the card.

Features:

- In addition to IndusMoney points, cashback is offered on purchases. For the first swipe, 500 bonus points are given, 200 for activating the card at any ATM run by IndusInd Bank, and 100 for turning on mobile banking. Daily cash withdrawal limit of Rs. 1.5 lakhs and a daily limit of Rs. 3 lakhs for purchases made with the card.

- A monthly fuel surcharge waiver of 250 rupees.

- 2 lakhs of insurance coverage in case of accidents or fatalities.

- Lost card liability of Rs. 3,00,000.

- Personal accident insurance of Rs. 2,00,000.

- Purchase protection of up to Rs. 50,000.

Fees and Charges:

For exclusive customers, the annual fee for this card is Rs. 299+ tax.

11. Bank of India RuPay Platinum Debit Card

The Bank of India RuPay Platinum Debit Card is a contactless card offering various features and benefits. It provides personal accident and total permanent disability cover and access to airport lounges.

Features:

- The card can be used domestically and internationally for transactions up to Rs. 1,00,000 at POS and e-commerce outlets in India.

- It also offers access to domestic airport lounges twice per calendar quarter and international lounges twice per calendar year.

- For contactless transactions below Rs. 5,000, no PIN is required.

- Cardholders can earn rewards points for transactions at POS and e-commerce outlets.

Fees:

The Bank of India RuPay Platinum Debit Card has an issuance charge of Rs. 250 and an annual maintenance charge of Rs. 250. The charge for card replacement is Rs. 250.

The ATM withdrawal limit is Rs. 50,000 daily for domestic and international transactions. The POS and e-commerce transaction limit is Rs. 1,00,000 for domestic transactions and Rs. 1,00,000 for international transactions.

12. Axis Burgundy World Debit Card

Axis Burgundy World Debit Card is an ideal choice for frequent travellers. This card offers many travel benefits, including free ATM withdrawals from any bank's ATM and high transaction limits. It also has enhanced features like a contactless payment option for faster and safer shopping in selected stores.

Features:

- Earn two edge royalty points for every Rs. 200 spent domestically and 6 edge royalty points for every Rs. 200 spent abroad.

- Discounts at select restaurants, movie tickets, insurance covers, and fuel surcharge waivers.

- Complimentary lounge access at select airports in India for added comfort while travelling.

- High transaction limits.

- Free ATM transactions.

- A waiver on charges.

- Complimentary movie and non-movie tickets.

- Personal accident insurance cover of Rs. 15,00,000.

- Contactless payment feature.

Fees:

Annual fees: Nil

ATM withdrawal limit (per day): Rs. 3,00,000

POS limit per day: Rs. 6,00,000

13. HDFC Women’s Advantage Debit Card

This debit card is designed specifically for women and offers a range of benefits and features catering to their shopping and financial needs.

Features:

- Cashback: The card offers great cashback on insurance, mutual funds, fuel, and more.

- Each Rs. 200 you spend on items from SmartBuy, Telecom, PayZapp, utilities, groceries, supermarkets, etc., will earn you one reward point. The points are valid for a year.

- Protection: The card offers protection against fire and burglary of up to Rs. 2 Lakhs. Additionally, customers enjoy a 50% discount on locker fees for the 1st year.

- The card includes Rs. 5 lakhs of insurance against air, road, or rail death.

- This card lets you make quick, simple, and secure purchases at any retail location.

- Accidental Cover: The card offers an accidental death cover of Rs. 10 lakhs, accidental hospitalization cover of Rs. 1 lakh, and a daily cash allowance of Rs. 1,000 per day for a maximum of 10 days per year for each day of hospitalization due to an accident.

Fees:

The annual fee for the HDFC Women’s Advantage Debit Card is Rs. 150 + GST.

14. ICICI Bank Coral Contactless Debit Card

The ICICI Bank Coral Debit Card is packed with exciting offers and rewards for dining, entertainment, shopping, and every transaction. It also offers gift vouchers when you apply for the card.

Features:

- Receive a bonus of 1000 PAYBACK reward points on your first transaction, whether it's online shopping or retail purchasing.

- Comes with Emergency Assistance and Fraud Protection for added security.

- Provides insurance protection, including Rs. 20 lakhs in air accident insurance, Rs. 10 lakhs in personal accident insurance, and Rs. 2.5 lakhs in purchase protection for items bought with the card. Get a 20% discount on hotel stays of at least two nights.

- Enjoy exclusive discounts and offers for dining, shopping, and entertainment.

Fees:

- Joining fee: Rs. 599 + GST for the first year

- Annual fee: Rs. 599 + GST from the second year onwards

- Any time a Coral debit card is reissued, there are reissue fees of Rs. 200 plus GST.

15. JetPrivilege HDFC Bank World Debit Card

JetPrivilege HDFC Bank World Debit Card is a debit card offered by HDFC Bank that is perfect for travellers. This card provides benefits like free accidental death insurance, discount vouchers for flight tickets, and rewards from JPMiles that can be redeemed for free flights.

Features:

- Welcome bonus of 3,000 JPMiles

- Discount vouchers for flight tickets when booking through Jet Airways

- Earn 2 JPMiles for each rupee of Rs. 150 spent on ticket purchases at the point-of-sale

- When purchasing any domestic ticket through Jet Airways Insurance, you will receive a 5% discount.

- Filling up at any gas station in India has no added cost.

- Access to MasterCard lounges in airports across India

Fees:

- Annual fee of Rs. 500 plus GST

- Joining bonus of 500 InterMiles on spending Rs. 150 from the date of issue of the card subject to payment of annual fees

- Renewal bonus of 500 InterMiles on spending Rs. 150 from the date of renewal of the card subject to payment of annual fees.

16. SBI Global International Debit Card

The SBI Global International Debit Card is one of the best debit cards in India that provides the convenience of cashless transactions and easy bill payments.

This card grants users access to more than 43,000 ATMs throughout India as well as cashbacks and savings on online purchases made through stores like Flipkart and Amazon.

Features:

- Shopping at more than 30 million international outlets and 52 lakh merchant outlets in India.

- Movie ticket purchases, bill payments, travel arrangements, and other online purchases and transactions.

- Cash withdrawal from 43,000 SBI ATMs or domestic and global ATMs.

- Online shopping and e-commerce transactions that are safe and secure.

- An NFC-enabled card in an NFC terminal can make a maximum of 5 daily transactions without a pin, up to a maximum of Rs. 5000.

- Daily cash withdrawal limit of Rs. 40,000.

Fees:

The annual fee for the card is Rs. 125 plus taxes for annual maintenance.

17. Axis Priority Platinum Debit Card

The Axis Priority Platinum Debit Card is a special card designed for Axis Bank's Priority customers. It is packed with exciting features and benefits, exclusively available to the customers of this card.

Features:

- With this card, you can earn cashback on movie purchases and enjoy a daily cash withdrawal limit of Rs. 1 lakh and a daily purchase limit of Rs. 4 lacks.

- You can withdraw cash from any domestic ATM without any additional charge.

- Additionally, the Axis Bank Dining Delights program offers more than 15% discounts at over 4,000 restaurants in India.

- You also get a fuel surcharge waiver of Rs. 200 each month and 5 lakhs of insurance coverage in case of accidents or fatalities.

- You can enjoy premium privileges and services designed exclusively for Priority customers, such as airport lounge access and the ability to withdraw money from any bank’s ATM without additional charges.

Fees:

The Axis Priority Platinum Debit Card has no annual fee or issuance fee. However, if you need to get a replacement or re-issuance the card, you will be charged Rs. 200 plus applicable GST.

18. IDBI Visa Signature Debit Card

IDBI Visa Signature Debit Card is a premium card issued by IDBI Bank. This card provides several privileges and offers in shopping, fine dining, health, and fitness. It is issued on the Visa Signature platform.

Features:

- Customers get free access to two airport lounges per year using the Signature debit card.

- The insurance coverage included with this card includes fire and burglary insurance worth Rs. 50,000, personal accident insurance worth Rs. 5 lakhs, and air accident insurance worth Rs. 25 lakhs.

- Using this card to book movie and travel tickets online and get the biggest discounts possible up to a daily limit of Rs. 3 lakhs for online transactions.

- The cash withdrawal limit is Rs. 3, and the purchase limit at the Point of Sale (POS) is Rs. 5 daily.

- Customers get 3 loyalty points for every Rs. 100 spent at merchant locations.

- The card also offers four free visits per calendar quarter at participating airport lounges in India.

Fees:

- Issuance Fees: Rs. 150/- plus taxes

- Annual Fees: Rs. 799/- plus taxes

- Add-on/Additional Card: Rs. 799/- plus taxes

- Replacement: Rs. 799/- plus taxes

19. HDFC Times Points Debit Card

The HDFC Times Points Debit Card is a popular online Debit Card available for both residents and NRIs in India. It has several benefits for online shopping, dining, and grocery partners, allowing you to earn Times Points for every shopping transaction.

Features:

- Offers an insurance amount of Rs. 2 lakhs in case of fire and burglary.

- Transactions above Rs. 5,000 can be converted to EMIs at no additional cost for purchasing smartphones, apparel, furniture, and electronics.

- Has a daily domestic Shopping Limit of Rs. 3.5 lakh and a daily domestic ATM Withdrawal Limit of Rs. 1 lakh.

- Provides complimentary lounge access at all airports in India.

- The Times Points Debit Card has many benefits catering to categories like online shopping, dining and grocery partners.

- You can earn Times Points for every transaction you make, which can be redeemed for various offers and rewards.

Fees:

The annual fee for the HDFC Times Points Debit Card is Rs. 650 plus taxes.

20. Axis Bank Burgundy Debit Card

Axis Bank Burgundy Debit Card is among the best premium debit cards in the Indian market. This contactless debit card has the highest withdrawal limit in India, and you need to maintain a minimum balance of Rs. 10 lakhs or pay a high renewal fee to get this card.

Features:

- This debit card offers high online payment and ATM cash withdrawal limits, cashbacks, and free ticket offers.

- You can make hassle-free transactions with a daily cash withdrawal limit of Rs. 3 lakhs and an online payment limit of Rs. 6 lakhs.

- The card also provides a VIP facility at airports and lost card liability of up to Rs. 6 lakhs.

Fees:

The annual fee for the card is Rs. 3000 plus GST.

Conclusion:

By now, you have a better understanding of the features and benefits offered by some of the best debit cards available in the Indian market. Whether you are a frequent traveller or a savvy shopper, there is a debit card out there that can cater to your needs and provide added convenience and security to your transactions.

So why wait? Take the first step towards getting the right debit card for yourself and enjoy the perks and rewards that come with it. Happy banking!